CHINA’S CONTRIBUTION TO SKILLS DEVELOPMENT IN SUB-SAHARAN AFRICA

By Dr. Sajitha Bashir, World Bank

The scale of China’s engagement in Sub-Saharan Africa is impressive and is expected to grow substantially if future projections of Chinese investments materialize. By 2013, China accounted for a quarter of all SSA trade. Estimates of the stock of Foreign Direct Investment (FDI) vary from the official estimate of $ 24 billion to $ 61 billion. (The China Global Investment Tracker estimated the stock of FDI to be $ 61 billion in 2013 and the value of Chinese contracts, a proxy for committed investment flows, to be US$82 billion in the same year - Pigato and Tang, 2015).

Introduction

During his visit to Africa in 2014, Premier Li Keqiang predicted that trade volume with Africa would double by 2020 to US $400 billion. Further, Chinese foreign direct investment (FDI) is expected to increase to US$ 100 billion in the same time period. Not only are the levels of investment rising but they are also becoming more diversified and expanding in manufacturing and services, compared to the past when investments focused primarily on infrastructure and energy. Although the recent slowdown in the Chinese economy has repercussions on the demand for commodities and hence for growth in resource dependent SSA economies, the re-balancing of the Chinese economy towards greater domestic demand and rising wages in China offers new opportunities for exports of labor-intensive manufactures. The December 2015 Forum on China- Africa Cooperation (FOCAC) Summit, held in Johannesburg, provided further impetus to these trends, given the new pledges of financing made by China.

Despite China’s growing role as a trade and development partner for Africa, little is known about China’s current contribution to skills development in SSA countries, whether through the private sector or through the government. In a situation where most traditional bilateral partners focus on aid for basic education in SSA countries, the role of new Partners, including from the South, can be both impactful and catalytic, especially in building up critical higher level technical/ scientific skills. China’s investments and growth in foreign trade could contribute significantly to economic diversification in SSA countries, and the creation of better quality jobs in the nonagricultural sectors that could absorb the growing numbers of young people who enter the labor market every year. Many SSA countries are looking to emulate the experience of China and other East Asian countries, which used FDI and integration into regional production networks to embark on a process of sustained structural transformation. The emergence of ‘export capable’ domestic firms, as key feature of this process was strongly driven by FDI in the initial stages (Yusuf, 2014). However, broad-based economic transformation required other key policy ingredients, including the creation of the appropriate business environment and investment in infrastructure, as well as, quite critically, investment in skills of the labor force.

In East Asian countries, government policy often included provisions for employment and training of local workers as well as encouraging foreign firms to invest in broader training efforts that benefit an industrial sector as a whole, rather than just the individual firm. This reinforced the direct effects of FDI in raising the skill level of the labor force, as foreign firms tend to invest more in training of their own workers and of their suppliers, and these trained and more productive workers start getting employed in domestic firms. Hence, a central factor in ensuring that China’s investments deliver on economic and social returns for both China and Africa depends on complementary investments in the skills of the local labor force. Given the scale of China’s investments in African economies, both the direct investment by Chinese firms in skills development as well as Chinese government support for skills development are important. The creation of an appropriate policy framework in SSA countries to leverage increasing Chinese FDI to invest in training of young workers will also be critical.

The Partnership for Skills in Applied Sciences, Engineering and Technology (PASET), a regional initiative launched by several African countries and the World Bank which focuses specifically on building the skilled labor force in sub-Saharan African countries (from technical, vocational to higher education and research), provides a platform to align the investments and efforts of different partners, including with new Partners. Under the PASET framework, Chinese academic institutions have participated in various regional Forums, in analytical work and in sharing the experiences of China in the development of capacity in vocational training and science and technology. This article synthesizes the current role of China in skills development in sub- Saharan Africa, drawing on many of these studies.

Chinese Firms in SSA countries

At present, Chinese firms, like many foreign firms operating in sub-Saharan African (SSA) countries encounter serious skills constraints. Such skills shortages are encountered even in low skilled jobs, where many workers lack basic competencies such as literacy, numeracy and non-cognitive skills required for the work place such as punctuality and discipline. This arises from the low level of education attainment of the domestic labor force and the low quality of basic education.

Skills shortages are even more severe at the level of technicians and higher level skills of professionals such as engineers, scientists, accountants, and others. In the short term, and especially in order to deliver large scale infrastructure projects on time, Chinese firms have often resorted to importing skilled labor, in addition to qualified professionals such as engineers and architects. This reliance on Chinese skilled workers is a distinctive feature of Chinese investment in Africa and has social ramifications for host countries. Chinese firms have sometimes also taken African workers to China for training, but this is not a viable long term strategy, because of the associated high labor costs.

Chinese FDI flows into Sub Saharan African countries are channeled through four main types of firms (Kaplinsky and Morris, 2009). The differences between these firms, which is an essential feature of Chinese FDI, also has implications for what the Chinese government can do to encourage Chinese firms to invest in skills development. The four broad categories are (i) Central government State Owned Enterprises (SOEs); (ii) Provincial government SOEs; (iii) private owned enterprises, incorporated in China and Sub Saharan African countries; and (iv) small firms, incorporated in Sub Saharan African countries, often started by Chinese individuals living in the countries. Investment by the latter is probably not captured at all in official FDI statistics.

This proliferation of investor types also accounts for the broad sectorial distribution and segmentation of Chinese FDI and its distinctive impact on local economies. The large SOEs invest primarily in natural resources, infrastructure and construction, receiving financing from China Development Bank, China’s EXIM Bank and other Chinese banks, and often supported by government to government agreements. The private owned enterprises are largely self-financed and invest in manufacturing and services (such as telecommunications). The share of private firms in Chinese FDI in Africa has increased from negligible amounts in the early 2000s to about 45 percent. The fourth category consists of very small Chinese investors who operate in small scale manufacturing and retail trade, who are likely to have come to Africa to work on FDI projects.

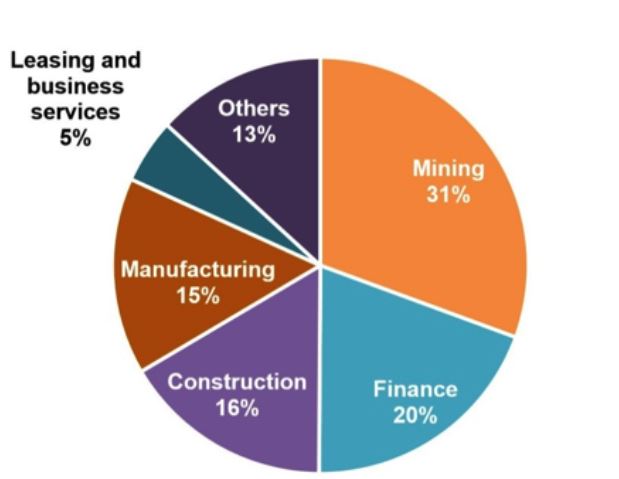

The total number of Chinese firms operating in Sub Saharan African countries is not accurately known but is estimated to be about 2,200 (UNCTAD, 2014). These firms operate in a range of sectors, as mentioned above. Figure 1 provides an estimate.

Figure 1: China’s FDI stock in Africa by end of 2011

Source: http://www.wri.org/blog/2014/05/where-are-chinese-investments-africa-headed

Very little is known about the employment impact of Chinese FDI or the employment profile of Chinese firms operating in Sub Saharan African countries. A recent review, based on the estimate of jobs created by greenfield projects, suggests that the employment impact is larger for manufacturing and construction, as might be expected, and for government-led projects compared to private projects, largely due to the size of the former (Pigato and Tang, 2015). There is even less data about the ratio of Chinese to domestic workers in these firms.

One estimate indicates that in 2013, approximately 215,000 Chinese workers came to Africa to work, which was 18 percent higher than in 2011.An early study on China’s role in infrastructure development in Africa, which drew on field work with construction companies in Angola, Sierra Leone, Tanzania, Zambia and China, noted that: “Labour has been an extremely contentious issue in all the countries surveyed” (Corkin et al, 2008). The study found that the general perception that Chinese firms bring in their own labor instead of using local labor is not necessarily true. However, local workers tended to be “predominantly employed as unskilled, casual workers”.

Ethiopia: How Chinese Firms Meet Labor and Skills needs

A recent World Bank study of labor and skills issues in Chinese firms in Ethiopia sheds some light on the impact of Chinese firms on job creation and skills development. Ethiopia has been very proactive in attracting Chinese investors to promote labor intensive industries as a part of a strategy to diversify its economy. Together with heavy investments in infrastructure, the government has also sought to leverage its inexpensive labor force to attract FDI, especially from China, into manufacturing and other sectors. While the overall educational attainment of the labor force is low, due to the low base from which Ethiopia started, the country has made targeted investments in technical/ vocational education and training, as well as in higher education, with a special focus on science and technology.

The study draws on a survey of the universe of Chinese firms known to the Chinese Embassy to be in operation in Ethiopia in 2012 and compares this to a sub-sample of domestic firms in the World Bank Enterprise survey for 2011 to highlight differences between Chinese and domestic firms. Despite the fact that Chinese FDI has likely changed in its volume and possibly in its composition since 2011, this study still provides some important insights.

The Chinese firms in the sample were overwhelmingly privately owned (the third category of the four categories described earlier) with only 14 percent being government owned. Government owned firms operated in construction and transportation sectors. The privately owned firms were in manufacturing as well as services. There were relatively few joint ventures with Ethiopians.

This relatively small number of Chinese firms are, however, significant employers in Ethiopia. Chinese firms accounted for 18,368 full-time (FT) jobs equivalent to 6.5 percent of the total FT permanent jobs (282,306) in the formal non-agricultural sector in Ethiopia. Of these fulltime jobs, 86 percent are held by Ethiopians as are 99 percent of the temporary jobs created in these firms. Median wages in Chinese firms (US$ 2296) are higher than in domestic firms (US$1380).

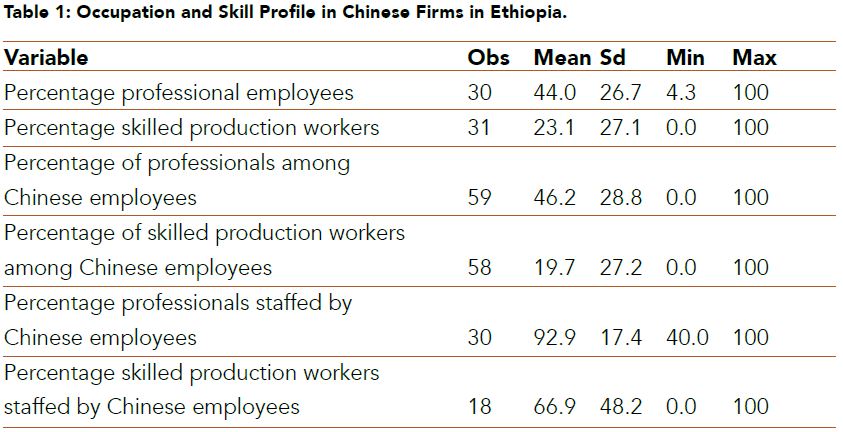

Despite this significant creation of better quality jobs, relatively few of the skilled and professional positions are held by Ethiopians. Table 1 presents the occupational and skill profile of Chinese firms that responded to these questions. 93 percent of all professional positions and 67 percent of skilled production workers in these firms are Chinese. Among all Chinese employees, 46 percent are professional workers while 20 percent are skilled production workers.

This may indicate the preference of Chinese firms for home workers, but another explanation is that there is an insufficient supply of skilled Ethiopian workers for the types of jobs that are required. There are some indications that Chinese firms experience such shortages. More than 50 percent of Chinese firms indicated that an in adequately educated workforce is a major or severe constraint to their operations. Only 4 percent of domestic firms indicated that this was a serious constraint. This perception is stronger among Chinese firms in the manufacturing and construction sectors. This may indicate the fact that Chinese firms operate in different markets and operate on a large scale, and hence demand a different type and quality of skills. Overall, as stated earlier, the Ethiopian government’s investments in basic education, TVET and higher education is sufficient for the domestic sector, given Ethiopia’s relatively small manufacturing basis. However, these investments may not be providing the kind of quality that is required for foreign firms that are competing globally.

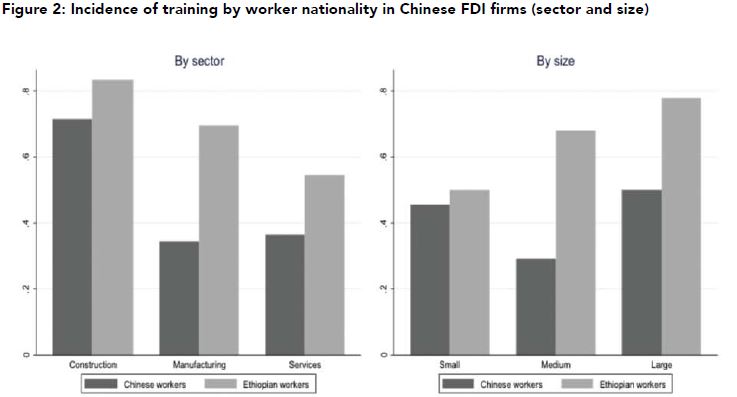

What is equally interesting is that even those Chinese firms that have operated in Ethiopia for a long time—and for whom, hence information about securing better quality workers is presumably not a problem—indicate that the quality of skills is a constraint. A significantly greater proportion of Chinese firms (75 percent) invest in training of workers compared to domestic firms (27 percent) (see Figure 2). Furthermore, a greater percentage of Ethiopian workers (69 percent) benefit from training, compared to Chinese workers (40 percent). Larger firms tend to offer more training, and training is also positively correlated with several measures of education— both findings are consistent with findings from the broader literature, suggesting that Chinese firms operate according to similar parameters.

The study’s findings, although based on a small sample, throw some light on commonly held perceptions about the operations of Chinese firms. In Ethiopia, indeed, there has been a high level of dependence by Chinese firms on skilled Chinese labor, whether due to preference or lack of local supply. This can limit the “spillover” benefits from Chinese FDI to domestic industry. On the other hand, the significant employment creation effects as well as firm level investment in training contradict general perceptions about low domestic impact.

Firm-based training is useful for firm specific skills, but if Chinese firms are also investing in training of local workers in generic skills or broader occupational skills, there is an argument for policy intervention to encourage more of such training. Further, transferring the training in such skills to local institutions (rather than taking workers to China) could both lower the costs of training to firms and help local training institutions upgrade and adjust their training programs to meet employer needs. Such interventions could benefit a broader group of firms in the sector, both foreign and domestic, and thus contribute to improving productivity across the board.

China’s Contribution to Skill Development in Africa

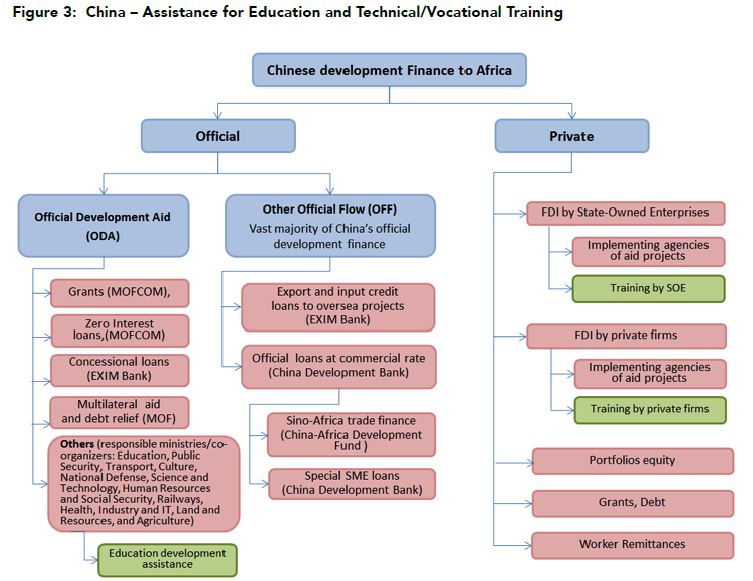

China’s involvement in providing assistance to education, training, and research, particularly in science and technology, in Sub Saharan African countries has long historical roots. Traditionally, it has been provided by the Chinese government through bilateral agreements. Since 2000, this assistance has been undertaken within the framework of the Forum on China-Africa Cooperation (FOCAC). As stated earlier, a new set of actors comprises the Chinese SOEs and private firms who are investing in the continent. Figure 3 provides a schematic overview of the channels for assistance/investment in education and training.

Note: Author’s representation based on China’s Foreign Aid White Paper, various years; Brautigam (2011); King (2011); websites of various Chinese Ministries and agencies.

Chinese Government Assistance for Education and Training

Focusing on the government’s direct aid (ODA), education and training, broadly defined, is estimated to have received between US$ 432-850 million in the period 2010-2012, based on the latest White Paper on China’s foreign assistance (State Council of China, 2013). There is no separate demarcation for education sector, which is included under the ambit of Human Resource Development (HRD).

The figure of US$ 432 million relates directly to the human development cooperation element of the foreign aid appropriation for 2010-12 and represents about 5.6 percent of total official foreign during this period. In addition to this, a significant amount of training is provided under the programs for agriculture and industry (for instance, programs under agriculture support technical/vocational centers and agriculture technology centers).

The larger figure of US$ 850 million includes aid given for agriculture and industry. The contribution to education and training is therefore not insignificant. A striking feature of the various aid programs in education and training which have burgeoned since the launch of FOCAC, is the increase in the number of Ministries that are involved. The main ministry coordinating foreign assistance is the Ministry of Commerce; however, sectorial Ministries are involved in designing implementing the specific programs. A rising trend of cooperation in education and training by the Chinese government can be seen since the launch of Forum on China-Africa Cooperation (FOCAC) in 2002, which is the main institutional mechanism for determining aid to African countries. This is in addition to bilateral agreements between China and various African countries. Five key modalities are used by the Chinese Government:

- Chinese governmental scholarships for Sub Saharan African students and providing places in Chinese universities for self-financed students from African countries;

- Providing training for Sub Saharan African officials and professionals technicians in a range of fields;

- Sending professional experts to Sub Saharan African countries to undertake specialized training;

- Building education infrastructure and providing equipment;

- Partnership programs implemented by various governmental ministries such as the Ministry of Education, Ministry of Science and Technology, Ministry of Foreign Affairs etc.

Scholarships

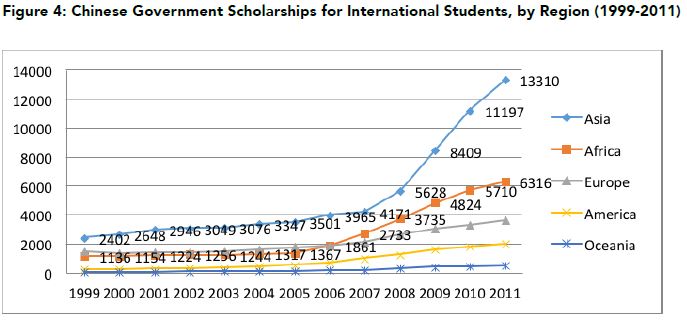

The number of scholarships has grown rapidly since 2006, especially for Africa. (Figure 4). The annual increase in scholarships has averaged 835 and in 2011, a total of 6316 scholarships were given to Africans. About 40 percent of these scholarships are in the applied sciences, engineering or technology fields, reflecting the demands from the African countries to build up skills in this areas. The remaining scholarships continue to be in humanities, social studies and Chinese language. In addition to the Central government, provincial governments and some enterprises also provide scholarships but the numbers are not available. Equally striking is the rapid growth in self-financing students, which increased from almost zero in 1989 to over 26,000 in 2013. Cumulatively, close to 95,000 African students have studied in China in this period, constituting 78 percent of all students.

Professional training:

This segment has also seen a significant rise, with 27,000 people (mainly administrators and others) being trained in China through short-term courses. The training covers economics, foreign affairs, energy, industry, agricultures, forestry, animal husbandry and fishing, medicine and health care, inspection and quarantine, climate change, security and other subject areas. However, the majority of training is for African government officials; only about 20 percent of trainees are technicians or professionals.

Professional experts:

China has also dispatched professional experts to African countries, especially in the areas of agriculture, vocational and technical education, and health. A particular striking case is the close cooperation with Ethiopia in technical and vocational education.

Over 400 teachers were sent to Ethiopia to train local teachers working in agricultural, vocational and technical education during 2010 to 2012. Further, China has established the Ethiopia- China Polytechnic College at a cost of $14 million to train TVET students, which has since 2011 become an institute to train TVET teachers. Tianjin University of Technology and Education is the partner Chinese institution. Education infrastructure and equipment:

Chinese investment in building schools, technical institutes and universities has also been undertaken. While the number of primary and secondary schools is relatively small (about 150 during 2010-2013), there have been significant investments at the post-secondary level. The details of total funding and distribution of this aid, which is mostly concentrated on infrastructure and equipment, is not available. Examples of new universities are those which are being built in Senegal and Malawi. In Malawi, the Export-Import (EXIM) Bank of China provided a loan of $70 million in 2010 to establish the Malawi University of Science and Technology. Several countries have obtained aid for scientific and technical equipment in universities and research institutes as well as building of technical/vocational centers.

New partnership programs: The most significant partnership programs for education and training are those related to higher education under the Ministry of Education (the 20+20 university partnership program), the China-Africa Science and Technology Partnership Plan (CASTEP) under the Ministry of Science and Technology (which promotes joint research), the Agricultural Technology Demonstration Centers under the Ministry of Agriculture and the China-Africa Joint Research and Exchange Program under the Ministry of Foreign Affairs .

China Development Bank’s Assistance for Skills Development in Africa

In addition to assistance provided by the Chinese government, China Development Bank (CDB), which is China’s leading cross-border financier, has invested mainly in short-term training through different modalities.

These included (i) CDB Training sessions for management-level staff from various government departments, financial institutions, and corporate partners in Africa. (ii) Joint Training Sessions covering China’s experience with economic reform and development as well as on the financial sector (iii) Corporate Leadership Program under which CDB funded an Executive MBA program for African entrepreneurs (particularly women entrepreneurs) at the China Europe International Business School (CEIBS) and (iv) CDB Scholarships for African students to study MA and PhD courses in Chinese, economics, finance, and management. Between 2007 and 2014, CDB organized a total of 57 such programs for beneficiaries from 52 countries. Investment by Chinese firms in TVET and higher education There is some evidence that Chinese firms are starting to invest in these areas, in addition to firm-specific training; however, comprehensive information is lacking. Two such examples are ZTE and Huawei, both telecommunications firms. ZTE University has set up training centers in a number of countries and a telecom college in Equatorial Guinea. Huawei has built seven training centers and one research and development center in South Africa. An especially interesting example is the agreement between the government of the Democratic Republic of Congo (DRC) and Chinese enterprises in 2007-8 relating to investment in the mining sector, which included agreements on local content so that no more than 20 percent of the workforce is Chinese; at least 0.5 percent of the investment is allocated to training, and 12 percent of the work is sub-contracted to local firms. China also agreed to build 2 universities along with hospitals and health centers, and other social infrastructure (Kaplinksy and Morris, 2009).

The Magnitude of Skill Shortage in Africa: Current Status and Priorities The educational and skill challenges in Sub Saharan Africa continue to be significant despite important improvements in access to basic education in the past decade. The new challenge is expanding the provision and quality of post basic education, especially secondary, technical and vocational, and tertiary, education. Success here will be a critical to ensuring that the continent continues to undergo structural transformation.

Sub-Saharan Africa lags behind other regions in the average skill level of its population. Although this has been increasing in recent years, the pace of growth is relatively slow, and certainly does not match the rapid increase in investment in physical infrastructure in recent years. One measure of the stock of human capital is the average years of education of the population, aged 25 years and more (that is, when most people have completed their education).

One estimate, based on a world-wide dataset, projected that the average years of education for SSA as a whole would be about 3 years in 2010. Using more recent household surveys for selected SSA countries, the average educational attainment may have increased to as much as 5.4 years. This dramatic improvement is largely due to the rapid expansion of access to primary education. Nevertheless, SSA countries lag behind other regions such as East Asia and Latin America (8 years) and Middle East and North Africa (about 10 years). The overall average education attainment hides significant variations across SSA countries. In general, many countries show a slow improvement, in particular middle income countries such as South Africa and Mauritius, which have an average of 8-9 years of education, and Kenya and Ghana, which are in the range of 5-6 years. Some have commendably accelerated their education attainment, albeit starting from a low base, such as Uganda, Tanzania and Rwanda. Their average years of education ranges between 4-5 years. At the other extreme, the average education level in Mozambique is still only about 3 years, while in conflict affected countries, of which there are several in SSA, the pace of increase would have been seriously disrupted if not reversed.

Providing quality basic education (8-9 years) to all African children will, therefore, continue to be a priority for African governments, as most new employment opportunities during the next decade will require relatively low skills (basic literacy and numeracy and non-cognitive traits will suffice). The increase in years of education attainment mask the effect of poor quality of education, which has deteriorated in many SSA countries. Poor learning outcomes at the basic education level also limit the number and quality of students who can access post-basic education and tertiary education.

However, over the next 10 years, several of the larger SSA countries, which could potentially diversify into more sophisticated higher technology activities, will be in need of more advanced skills beyond basic education, and especially in the applied sciences, engineering and technology (ASET). Moreover, even in the near term, a “critical level” of these skills will be needed to initiate the process of technological absorption and prepare the groundwork for a broadening of the industrial base. This requires training of workers in tertiary level and technical/ vocational institutions.

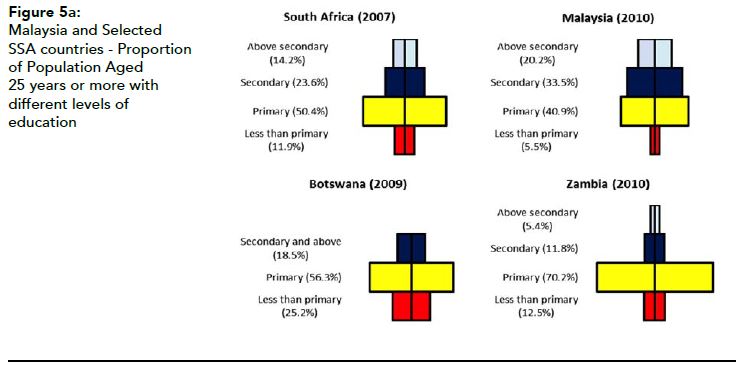

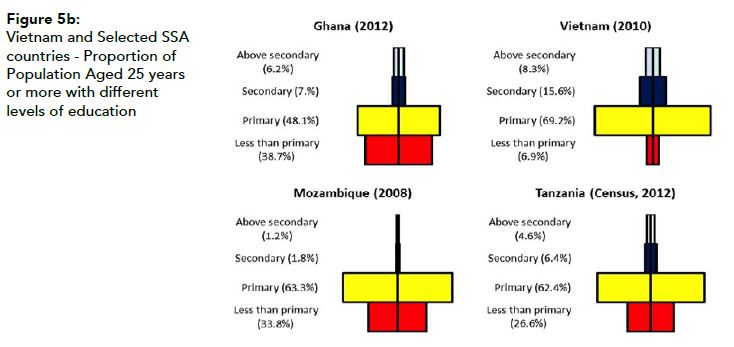

Currently, the proportion of the population with post-secondary education is extremely small, even in the middle income SSA countries, as well as in aspiring middle income countries, compared to comparator countries. For instance, 20 percent of the population in Malaysia has achieved more than secondary education. In South Africa, this proportion was 14 percent and in Zambia, just 5 percent. Both countries are significantly behind Malaysia in the proportion that has attained secondary education (24 percent and 12 percent, respectively, compared to 33 percent in Malaysia). In Botswana, the proportion of the population with secondary education and above was 19 percent, compared to 54 percent in Malaysia (Figure 5a). Figure 5 (b) compares the educational pyramid of Vietnam, a lower middle income country, with SSA countries that have recently attained that status (Ghana) and Tanzania and Mozambique, which are aspiring middle income countries. Clearly, the differences are stark, not only at the base of the pyramid, where significant proportions in SSA countries are illiterate, but also at the secondary education and post-secondary levels. Tanzania and Mozambique have roughly 4 % and 1 % of the population with more than secondary education compared to 8 percent in Vietnam.

Note to Table 5a and 5b: The proportion of the Population Aged 25 years and over with different levels of education in each country is based on author’s calculations using harmonized micro data from the International Income Distribution Database-I2D2 version 6 (World Bank 2013). South Africa estimates are calculated using and older version of I2D2 (December 2011). Tanzania attainment by levels is estimated using aggregated data by age and school attendance (never attended, currently attended, completed) from the 2012 Tanzania National Census. Malaysia levels of attainment are estimated using micro data from the 2010 Malaysia Labor Force Survey.

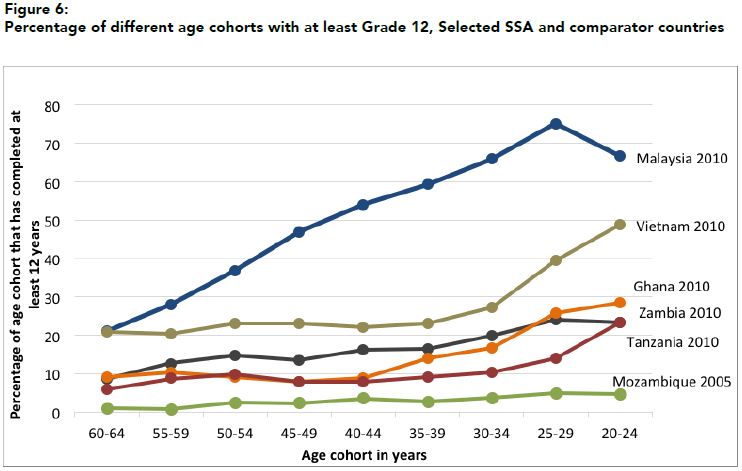

Using data from the most recent household surveys, we can also look at the rate at which SSA countries are upgrading their higher level skills. Figure 6 shows the proportion of different age cohorts that have at least 12 years of education for various countries in the SSA region compared to Malaysia and Vietnam. In Mozambique, one sees no appreciable increase in investment at higher education levels over the last 20 years. Tanzania, Zambia and Ghana have slowly increased the proportion of the population with at least 12 years of education in the same period, after a period of stagnation. Nevertheless, the gap with countries such as Vietnam and Malaysia has widened, as these countries have accelerated their accumulation of skilled labor.

Note: Except where indicated the Percentage of Attainment of at least Grade 12 (secondary complete and over) for different age cohorts is based on author’s calculations using harmonized micro data from the International Income Distribution Database-I2D2 version 6 (World Bank 2013). Survey year is rounded to the closest year multiple of five. For Malaysia the percentages are estimated using micro data from the 2010 Malaysia Labor Force Survey

Further disaggregation shows that the proportion of secondary students enrolled in technical- vocational courses is significantly below that in other regions, although consistent data are not available for many countries. Among those who reach higher education, the proportion who enroll in science and engineering courses is less than 25 percent; those enrolled in engineering constitute about 8 percent of the total (Saint, 2014). At the postgraduate level, except in very large countries such as Ethiopia and Nigeria, most Sub Saharan African countries have only a few hundred students enrolled in science courses. Further, enrollment in the science and engineering courses is not aligned to the sectors of growth, with students taking general science courses that have limited employment potential.

The poor quality of the training of technical/ scientific personnel is as much of a constraint as the limited numbers of professional and technical labor. Many Sub-Saharan scientists and engineers are unemployed because they lack the specialized competencies and skills required by firms. The poor quality of their training relates to the fact that curricula are outdated, most faculty lack PhD training, and students gain little practical experience during their courses. Faced with the enormity of the challenges in basic education, it is easy to overlook the critical needs of higher levels skills in the process of economic transformation and structural transformation.

THE POOR QUALITY OF THE TRAINING OF TECHNICAL/ SCIENTIFIC PERSONNEL IS AS MUCH OF A CONSTRAINT AS THE LIMITED NUMBERS OF PROFESSIONAL AND TECHNICAL LABOR.

The lack of technological capability of African firms as a constraint in improving productivity was highlighted two decades ago in a synthesis study of the World Bank’s Regional Program on Enterprise Development (Biggs and Srivastava, 1997).

The availability of technically skilled manpower is critical not only for individual enterprises but also for the emergence of competitively viable industries, as the diffusion of productivity enhancing technological knowhow is often through movement of individuals across firms and through sub-contracting of firms that can meet quality standards for inputs.

A recent study noted that the lack of adequately trained engineers is affecting development in every field, from rural sanitation to reduction of poverty (Royal Academy of Engineering (2012).

Conclusion

Economy wide skills constraints take about 10-15 years to emerge after periods of sustained growth. If Sub Saharan African countries are to continue on their sustained growth path, the time to address the skills constraints is now. Targeted investments in better quality technical/vocational education and training, higher education, and research are required for creating skills for the emerging growth sectors across the continent. Sub-Saharan Africa could benefit from better coordination with development partners to ensure that investments in these areas are well targeted and well-coordinated.

Although China’s assistance in this domain has increased, and is indeed substantial, it is still small relative to Chinese FDI and trade with Sub Saharan African countries. Further, at present, China’s approach to foreign assistance to Sub Saharan Africa involves many government bodies and is channeled through various modalities. Although the Ministry of Commerce is the leading coordinating body for foreign aid and assistance, human resource development projects are implemented across a number of ministries, higher education intuitions, enterprises and other agencies. While the involvement of a range of entities allows for specific areas of expertise to be drawn upon, greater coordination is required to avoid fragmentation and impact on outcomes.

This also requires efforts on the part of SSA countries to align the contributions of different partners, as has been done in the case of basic education. African governments can take the lead in ensuring coordination and complementarity of development partner investments. At the same time, greater sharing of information among partners themselves could also lead to greater synergy among investments and enhanced results on the ground.

Sajitha Bashir is Practice Manager in the Education Global Practice, World Bank. This article draws upon a background paper prepared by Sajitha Bashir and Reehana Raza for the “Investing in Africa Forum –

Partnering to Accelerate Investment, Industrialization and Results in Africa” organized in Addis Ababa (June30 - July1, 2014). The Forum was organized by the Government of the People’s Republic of China, the World Bank Group (WBG), China Development Bank (CDB), the China-Africa Development Fund (CAD-Fund), the Government of Ethiopia (GoE) and United Nations Industrial Development Organization (UNIDO).

The author wishes to thank reviewers from the China Development Bank, Shuilin Wang (World Bank), Aileen Marshall (World Bank) and Peter Materu (World Bank) for comments provided on the background paper. The findings, interpretations, and conclusions expressed in this paper are entirely those of the author. They do not necessarily represent the views of the International Bank for Reconstruction and Development/World Bank and its affiliated organizations, or those of the Executive Directors of the World Bank or the governments they represent.

Further Reading:

- Bashir, Sajitha and Reehana Raza 2014. The Imperative of Skills Development for the Structural Transformation of Sub-Saharan Africa: Potential for China-World Bank-Africa Collaboration. Background Paper for “Investing in Africa Forum”, Addis Ababa (June 30-July 1, 2015) Biggs, Tyler and Pradeep Srivastava (1997). Structural Aspects of Manufacturing in Sub- Saharan Africa: Findings from a Seven Country Enterprise Survey.

- Bräutigam, Deborah. , 2011. Aid ‘With Chinese Characteristics’: Chinese Aid and Development Finance Meet the OECD-DAC Regime. Journal of International Development23 (5): 752–764

- Corkin, L Christopher Burke and Martyn Davies (2008). China’s Role in the Development of Africa’s Infrastructure. Centre for Chinese Studies, Stellenbosch University. SAIS Working Papers in African Studies 04-08.

- Farole, Thomas and Winkler, Donald (Eds).2014. Making Foreign Direct Investment Work for Sub-Saharan Africa: Local Spillovers and Competitiveness in Global Value Chains. Washington D.C. The World Bank.

- Lacovone, Leonardo, Vijaya Ramachandran and Martin Schmidt. 2014. Stunted Growth: Why Don’t African Firms Create more Jobs? CGD Working Paper 353. Washington, D.C. Centers for Global Development.

- Leung, Denise and Lihuan Zhou. May 15 2014. “Where are Chinese Investments in Africa Headed?” Retrieved on November 6th 2014 from http://www.wri.org/blog/2014/05/whereare-chinese-investments-africa-headed

- Kaplinsky, Raphael and Morris, Mike. 2009. Chinese FDI in Sub-Saharan Africa: engaging with large dragons. European Journal of Development Research, 21(4), pp. 551–569.

- King, Kenneth. 2011. China’s human resource engagement with Africa: a new voice, new values, and a new partnership? Paper presented at “Rethinking Development in an Age of Scarcity and Uncertainty, New values, Voices and Alliances for Increased Resilience”, 19-22 September 2011 University of York.

- Pigato, Miria and Wenxia Tang. 2015. China and Africa: Expanding Economic Ties in an Evolving Global Context. Background Paper for the “Investing in Africa” Forum, Addis Ababa (June 30-July 1, 2015)

- Pinghu, Zhung. May 5th 2014. “Trade with Africa will double by 2020, Li Keqiang tells Ethiopian Conference.” Retrieved November 6, 2014 from South Morning China Post http://www.scmp.com/news/china/article/1505388/trade-africa-will-double-2020-li-keqiang-tellsethiopia-conference

- Royal Academy of Engineering. 2012. ‘Engineers for Africa: Identifying Engineering Capacity Needs in Sub-Saharan Africa’.

- State Council of China. 2013. White paper on China-Africa Economic and Trade Cooperation. Beijing. August, 2013.

- State Council of China. 2014. White paper on China’s Foreign Aid. Beijing. July, 2014.

- UNCTAD (United Nations Conference on Trade and Development). 2014. World Investment Report 2014: Investing in the SDGs: An Action Plan. Geneva: United Nations

- Yusuf, Shahid. 2014. Sustaining Ethiopia’s Growth Acceleration. George Washington University, Washington DC. March 12, 2014.

- World Bank (2013). “International Income Distribution Database (I2D2)” Washington, D.C.: World Bank.

- Background Studies done for the Partnership for Skills in Applied Sciences, Engineering and Technology (Mimeo)

- Banerji, Pradipta. 2014. India’s Current Activities and Contributions to Education, Training, and Research in Science and Technology in Africa. World Bank, Washington, DC.

- Carrillo, Susana and Karin Costa Vazquez. 2014. Brazil – Sub Saharan Africa: Partnerships for Human Development. World Bank, Washington, DC.

- Cheng, Ying and Nian Liu. 2014. A Benchmarking Study of Selected Applied Sciences, Engineering and Technology (ASET) Oriented Universities in Africa and China, Shanghai Jiao Tong University. Mimeo.

- Song, Yingquan 2014. China’s Contribution to Education, Training, and Research in Science and Technology in Africa – An Assessment of Current Activities. World Bank, Washington D.C.

- Saint, William. 2014. Applying Science, Engineering and Technology for African Competitiveness and Development. World Bank, Washington, DC.

- Tran, Trang. 2014. Labor and Skills in Chinese FDI Firms in Ethiopia. World Bank, Washington, DC.

Download